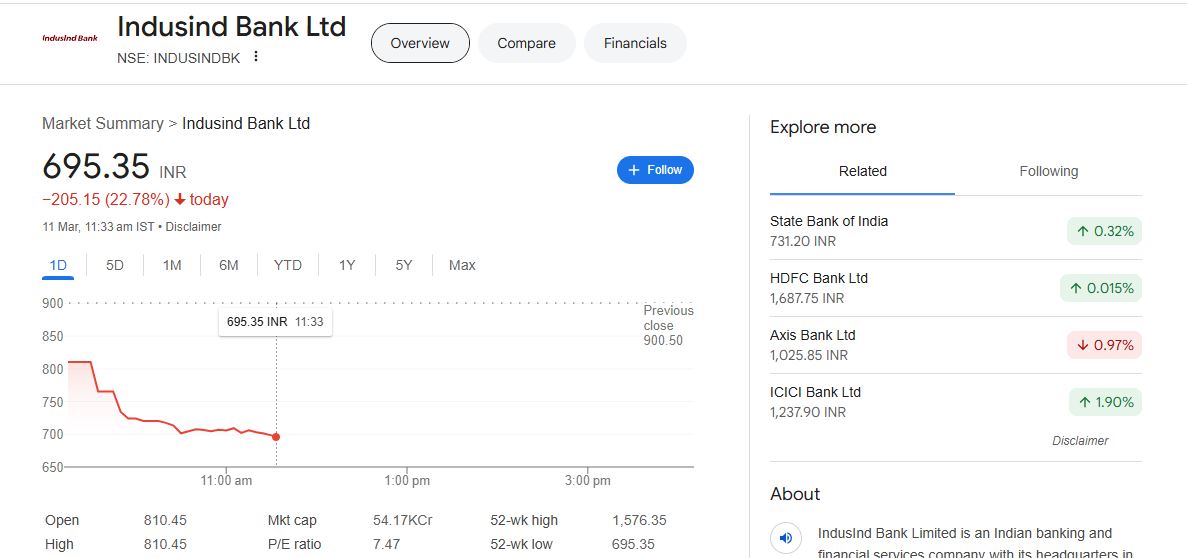

IndusInd Bank Shares Crash Over 22%: Kya Hai Accounting Gap Ka Asar?

India ke private lender IndusInd Bank ke shares Tuesday ko 22% se zyada gir gaye, jo ki last 4 saal ka sabse bada low hai. Yeh girawat tab aayi jab bank ne ek din pehle forex derivatives se judi accounting discrepancies ki baat kahi, jo bank ke earnings par ek baar ke liye bada impact daal sakti hai.

IndusInd Bank Ke Shares Aur Market Impact

IndusInd Bank ke shares benchmark Nifty 50 ke last 52 weeks ke sabse weak performers rahe hain. Yeh Tuesday ka single-session mein sabse bada fall tha jo March 2020 ke baad kabhi nahi dekha gaya tha.

Monday ko bank ne bataya ki December 2024 tak net worth me 2.35% ki girawat aa sakti hai. Yeh girawat ek underestimation ke wajah se hai jo kuch past forex transactions se judi hai. Par iske baare mein zyada details bank ne nahi di.

Also Read: Tata Harrier Ev: जानें इसके फीचर्स और दमदार परफॉर्मेंस

Kitna Ho Sakta Hai Nuksan?

Analysts ka maanna hai ki bank ka net worth approx 15 billion rupees se 20 billion rupees ($171 million – $229 million) tak impact ho sakta hai. Net worth ek important indicator hota hai jo kisi bhi company ki financial health ko define karta hai. Yeh assets aur liabilities ka difference hota hai.

CEO Sumant Kathpalia ne ek late evening conference call me bataya ki yeh accounting gap September-October period me identify kiya gaya tha. Yeh gap naye banking investment portfolio rules ke April 2024 se implement hone ke baad samne aaya.

Weak Internal Controls Ki Nayi Challenge?

Jefferies ke analyst Prakhar Sharma ke mutabik, yeh discrepancy specific types ke transactions se judi hai aur purane fiscal years ka issue hai. Lekin yeh bank ke internal controls ki weakness ko highlight karta hai. Sharma ka kehna hai ki bank ke 2024-25 earnings par ek baar ka impact dekhne ko milega aur stock ka valuation bhi impact ho sakta hai.

Market Experts Ka Kya Kehna Hai?

38 analysts jo IndusInd Bank ko track kar rahe hain, unme se 4 analysts ne “sell” rating di hai. Yeh rating pichle 2 saal me sabse zyada bearish sentiment dikhati hai. LSEG ke data ke mutabik, mostly analysts ne abhi bhi “buy” rating maintain ki hai.

Mumbai-based IndusInd Bank pehle se weak earnings aur CEO Kathpalia ke short-term extension ki wajah se uncertainty face kar raha hai. Analysts ka kehna hai ki derivatives disclosure investors ko ek major concern de sakti hai.

Nuvama ke analysts ka kehna hai ki yeh derivatives disclosure investors ke confidence ko negatively impact kar sakti hai, jo ek backdated non-performing loan disclosure se bhi zyada risk factor create kar sakti hai. Isi wajah se unhone stock ko “reduce” rating di hai.

IndusInd Bank Shares Ki Performance

October 2024 ke ek earnings miss ke baad se IndusInd Bank ke shares 46% tak gir chuke hain. Wahi Nifty 50 bhi same period me 8% aur banks’ index 7% gira hai.

Investors Kya Karein?

- Short-Term Investors: Agar aap short-term trading kar rahe hain toh abhi ke liye careful rahna zaroori hai kyunki stock volatility me hai.

- Long-Term Investors: Agar aap long-term view rakhte hain toh analysts ke mixed ratings ko dekhte hue decision lena chahiye. Market me further developments ka analysis karna zaroori hoga.

- Risk Management: High-risk investors ke liye yeh ek opportunity ho sakti hai agar stock discount par mil raha ho. Lekin zaroori hai ki puri research aur financial planning ke saath hi decision liya jaye.

Final Verdict

IndusInd Bank ki forex derivatives se judi accounting issue ek major red flag hai jo investors ke confidence ko shake kar sakti hai. Internal controls ki kami aur CEO extension uncertainty ke wajah se bhi stock under pressure rahega. Market me abhi cautious optimism maintain karna better hoga jab tak clarity na aaye.

Aapka kya view hai? Kya aapko lagta hai ki yeh stock rebound karega ya phir aur girawat dekhne ko milegi? Humein comments me zaroor batayein!